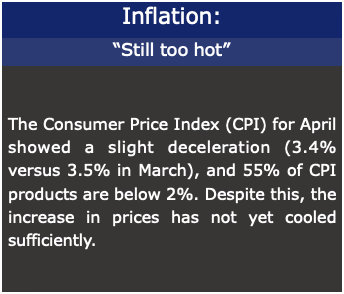

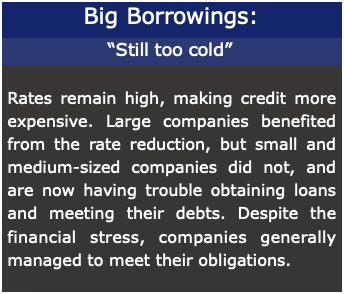

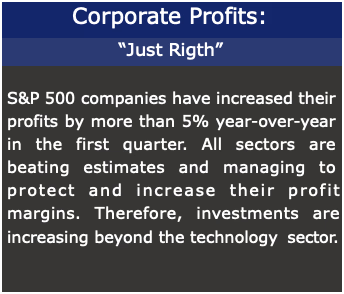

A recent JP Morgan publication indicates that the market's performance for the rest of the year depends on three key factors: inflation, the level of large long-term loans, and corporate earnings results.

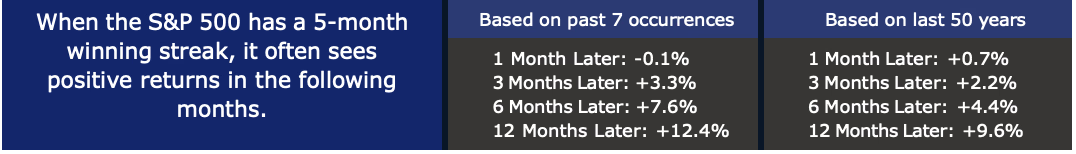

Overall, macroeconomic data shows improvements and the economy is approaching a fair balance, with inflation cooling and growth stabilizing. This is favorable for multi- asset investors. While it is important to monitor inflation and tighter credit, current trends point towards greater stability and investment opportunities. On the other hand, historical evidence anticipates a favorable scenario for capital markets.

Numa’s team believes that the S&P 500's decline in April represents a normal correction in the stock market, which could anticipate a significant recovery in the coming months. The team is continuously analyzing the market to identify the most favorable investment opportunities and make strategic decisions based on rigorous analysis.