to make decisions about the federal funds rate. The meeting is followed by a conference press given by

the Fed Chairman. Last meeting took place the 21 st- 22 nd March.

Meeting Key Highlights

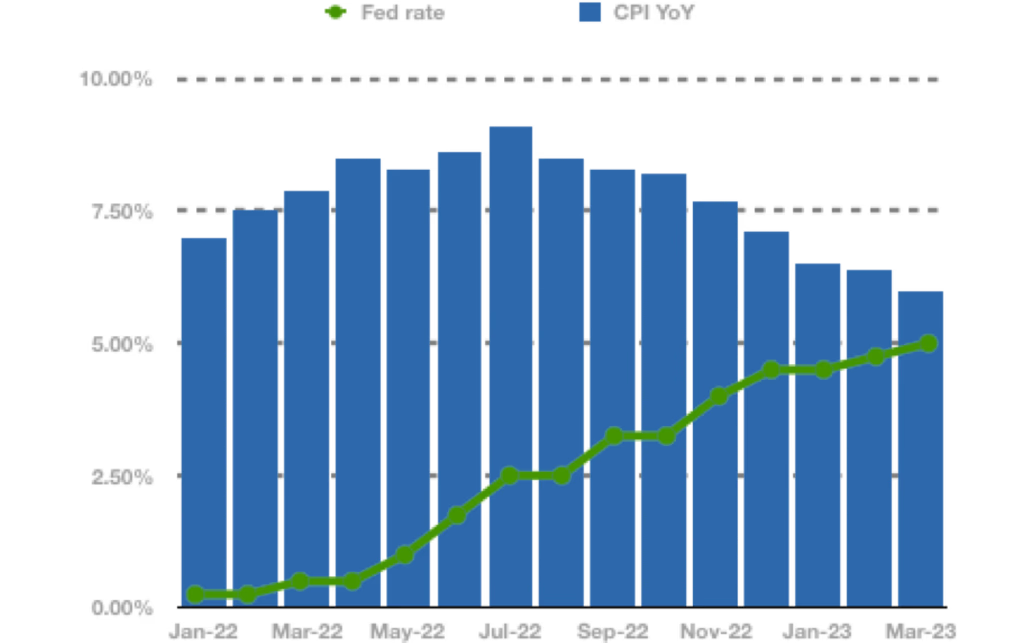

The FOMC has been implementing interest rate hikes to control inflation, as it remains elevated. Last Wednesday, the FOMC raised the federal funds rate by 25bps, to a range of 4.75%-5%. This is its 9th consecutive rate increase.Regarding the banking system, the FOMC considered it sound and resilient. Specifically, as for the bank run at Silicon Valley Bank, Jerome Powell -Fed Chair- considers this bank to be an “outlier in terms of both its percentage of uninsured deposits and in terms of its holdings of duration risk”.

Despite the volatility in the markets, Powell ruled out reducing interest rates during 2023 based on inflation and labor market data, considering the FOMC goal is for inflation to return to 2% over the long run.

The FOMC also released its latest Summary of Economic Projections. Regarding growth, The Committee expects it will be 0.4%, slightly lower than the previous projection (Dec22). Likewise, unemployment rate it's expected to be 4.5%, also lower than the last projection (Dec22). In addition, the majority of the FOMC members expects the federal funds rate peak at 5.1% in 2023.

How did the market react?

After the press conference, the market interpreted Powell' s message as slightly negative. Almost at the same time, the US Treasury Secretary Janet Yellen said the department will not take more action to save banks. Both messages resulted in a S& P500 Index decrease of 1. 63 % on Wednesday.